Prime Broker Services

Prime Brokerage Services

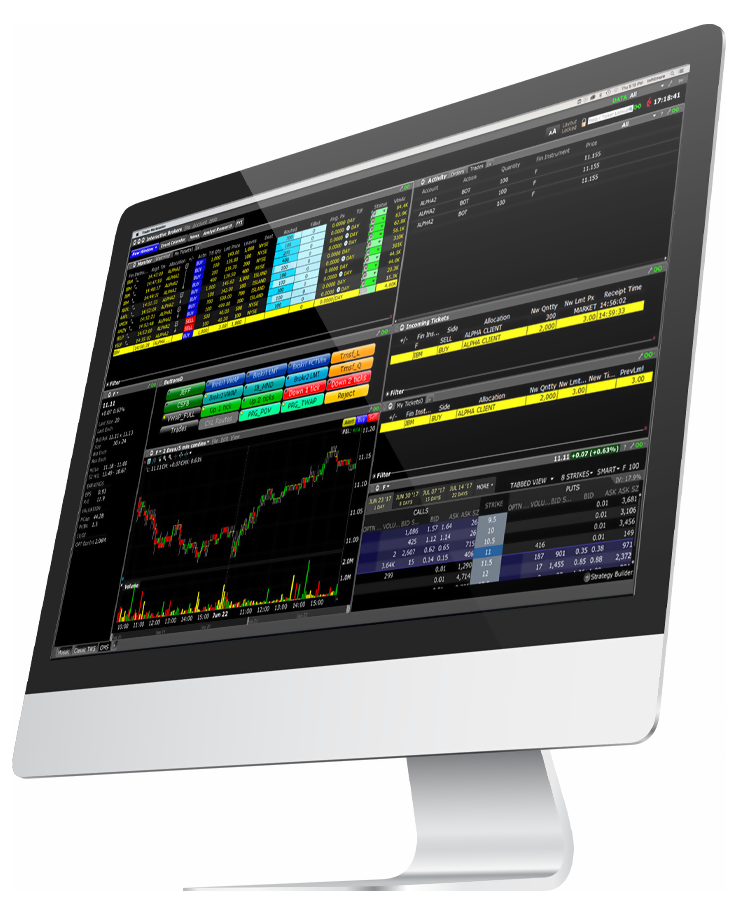

Interactive Brokers offers a comprehensive suite of prime brokerage services to meet the unique needs of hedge funds, family offices and managed accounts.

Securities Financing

IBKR combines deep stock availability, transparent stock loan rates, global reach, dedicated support and automated tools to simplify the financing process and allow you to focus on executing your strategies.