Model Navigator

Model Navigator: Advanced Option Pricing Analytics

Harness powerful modeling tools to refine assumptions and uncover pricing opportunities.

Unlock Smarter Option Pricing with Model Navigator

Model Navigator is an advanced option-modeling engine within IBKR’s Price/Risk analytics suite. It empowers traders to customize pricing assumptions such as volatility, rates, dividends, and lending yield—and instantly recalculate model prices with vivid visual feedback.

Go beyond standard option pricing and gain insights that help you trade smarter, faster, and with greater confidence.

With Model Navigator, You Gain

- Full structural transparency: View each option’s detailed framework at a glance.

- Precision and control: Tweak interest rates, dividends, lending yield, and implied volatilities with ease.

- Visual clarity: Color-coded model prices let you quickly see where they fall relative to the bid/ask.

How It Works

Model Navigator integrates current market data (for both the option and its underlying, or the futures reference contract for index options) to derive implied volatilities and model prices.

Its interface includes:

- Contract Tree View: Options grouped by underlying, expandable and sortable.

- Volatility Curve Plot + Table: Strike-based vol curve with color-coded market points for calls and puts, showing implied volatilities and allowing manual editing (add/remove knots, refit curves).

- Interactive Editing: Adjust volatility knots directly in the plot or table, update interest/dividend assumptions, and apply those edits to model pricing.

Setup Is Simple

- Launch Model Navigator

- Mosaic: Use New Window → search "Model Navigator"

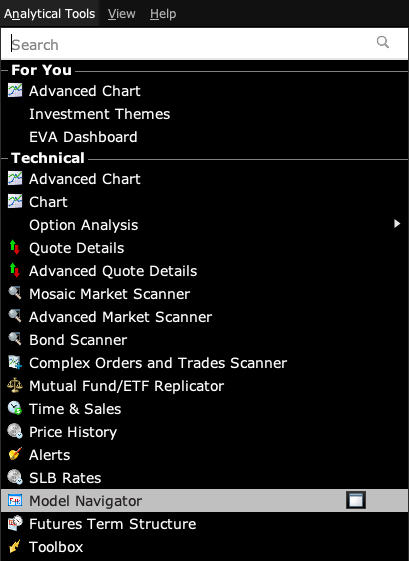

- Classic TWS: Go to Analytical Tools → Model Navigator

- Display Options

- Add the Model or Imp. Vol. columns to your Quote Monitor (click the "+" icon in the header). All displayed contracts will auto-populate into Model Navigator.

- Edit as Needed

- Modify interest or dividend schedules, lending yields, or volatility profiles.

- Save and compare custom model "snapshots" using the Model History feature.

Why It Matters

With Model Navigator, traders gain:

- Data-driven decision-making: See instantly how adjusted assumptions affect pricing.

- Execution confidence: Compare your model directly to market pricing.

- Strategic flexibility: Model custom scenarios and compare historical revisions visually.

USER GUIDES

Ready to Explore with Model Navigator?

For more information on Model Navigator, select your trading platform.

Any symbols displayed are for illustrative purposes only and do not portray a recommendation.

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking here.