Advisor

Registered Investment Advisors

Our turnkey custody solution helps advisors build a competitive advantage, manage their business with efficiency and serve clients at lower cost.

The IBKR Advantage

- No ticket charges, no custodial fees, no minimums and no technology, software, platform or reporting fees.

- IBKR does not have an advisory team or a prop trading group to compete with you for clients.

- IBKR can service advisor clients in over 200 countries and territories around the world.

- We provide a low-cost global trading and custody solution to advisors of all sizes.

- Trade stocks, options, futures, currencies, bonds and funds on over 150 markets from a single unified master account, and trade cryptocurrencies from the same platform.

- Choose from our Streamlined, Streamlined Plus and Full-Service client service models to deliver an experience tailored to your clients’ needs.

- Use Tax Loss Harvesting to reduce your clients’ tax liabilities.

- Use Custom Indexing to build portfolios that are modeled after Index ETFs and easily customizable for client investment goals.

- Streamline your workflow by investing client assets with Model Portfolios. Browse over 70 low cost, well-diversified portfolios or use our free advisor tools to create your own models.

- Free CRM, portfolio management and trading platform, plus PortfolioAnalyst®, a tool to consolidate your clients’ entire portfolio.

- Automated and flexible client billing.

- Free website building services.

Professional Pricing – Maximize Your Returns

IBKR offers the lowest1 cost and access to stocks, options, futures, currencies , bonds and funds from a single unified platform. If an exchange provides a rebate, we pass some or all of the savings directly back to you.

Learn About CommissionsMargin rates up to 49% lower than the industry.2

Compare Margin RatesEarn interest rates of up to USD 4.83% on instantly available cash.3

Compare Interest RatesEarn extra income on your lendable shares.

See Stock Yield Enhancement- Lowest Cost Broker according to StockBrokers.com Online Broker Survey 2023: Read the full article Online Broker Reviews, May 18, 2023. "Because Interactive Brokers' core clientele are professional traders and institutional investors (e.g., hedge funds), it is crucial to provide the lowest commissions schedule available. In our rigorous assessment, there is no question Interactive Brokers delivers."

- For complete information, see our margin rate comparison

- Restrictions apply. See additional information on interest rates. Credit interest rate as of April 2, 2024.

Technology to Help Advisors Succeed

Trading Platforms

Powerful, award-winning trading platforms and tools for managing client assets. Available on desktop, mobile, web and API.

Goal Tracker

Goal Tracker projects the hypothetical performance of a portfolio and monitors how likely you are to achieve your goals.

Order Types and Algos

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Advisor Tools

Spot market opportunities, analyze results, manage your account and make informed decisions with our free advisor tools.

Pre-Trade Allocations

Use IBKR’s pre-trade allocations to allocate block trades to multiple accounts with a single mouse click.

Allocation Order Tool

Transform and streamline the creation, execution and allocation of group orders. Project, preview and allocate trades to take advantage of potential capital losses for all or some of your invested clients. Develop and deploy investment strategies in minutes to capture opportunities in volatile markets.

Tax Loss Harvesting

Reduce your clients’ tax liabilities, using Tax Loss Harvesting

Free Account Tools

Manage taxes and corporate actions, learn about T+1 settlement and trade allocations, and read about additional tools and services available to clients.

Create Client-Centric Investment Portfolios

Model Portfolios

Models allow Advisors to create groupings of financial instruments based on specific investment themes and invest client funds into the Model, rather than taking time to invest in multiple, single instruments.

Custom Indexing

Create and customize direct index models based on the composition of ETFs tracking major indices.

Environmental, Social and Governance (ESG)

ESG scores from Refinitiv give you and your clients a new set of tools for making investment decisions based on more than just financial factors.

Impact Dashboard

Use the Impact Dashboard to identify and invest in companies that share the values held by your clients.

IBKR Client Risk Profile

Use the IBKR Client Risk Profile to understand client risk tolerances and recommend suitable investments for your clients.

ESG Impact Profile

Use the ESG Impact Profile to understand client preferences related to socially responsible and impact investing.

Retirement Plan Administration

Your clients can link their Employee Plan Administrator and SIMPLE IRA accounts to your IBKR Advisor account for professional management of retirement plans.

Spend Your Time on Your Clients

with Investment Models

Streamline your workflow by investing your client assets with Model Portfolios.

Establish a portfolio of financial instruments, and then trade this model on

behalf of your clients.

- Set target percentage allocations

- Invest all or a portion of clients’ funds into the model

- View and track model performance

We have four easy ways to get started with Models

| Browse over 70 low-cost, well-diversified portfolios |

Use our free advisor tools to create your own models |

||

|---|---|---|---|

Interactive AdvisorsTM |

Models by recognized institutions |

Symbol by Symbol |

Custom Indexing |

How it works |

|||

Select from 50+ portfolios in various styles such as Smart Beta, ESG, Asset Allocation and more. |

Select from top-tier vendor models designed by Cambria Investments, WisdomTree, John Hancock Investment Management, Global X, AGFiQ and many more. |

Build your model symbol-by-symbol. You have customized controls with advanced tools to manage and rebalance your investments. |

Create and customize direct index models based on the composition of ETFs tracking major indices. |

Ease of use |

|||

Customization |

|||

Exclude Certain Stocks |

|||

Rebalance Reminders |

|||

Auto-Rebalancing |

|||

Cost and Fees |

|||

Interactive Advisors: |

USD 0.01 to 1.00 |

USD 0.00 |

|

| Browse IA Models | Browse Vendor Models | Browse Model Portfolios | Learn About Custom Indexing |

| Browse over 70 low-cost, well-diversified portfolios |

|

|---|---|

Interactive AdvisorsTM |

Models by recognized institutions |

Select from 50+ portfolios in various styles such as Smart Beta, ESG, Asset Allocation and more. |

Select from top-tier vendor models designed by Cambria Investments, WisdomTree, John Hancock Investment Management, Global X, AGFiQ and many more. |

| Browse IA Models | Browse Vendor Models |

| Use our free advisor tools to create your own models |

|

|---|---|

Symbol by Symbol |

Custom Indexing |

Build your model symbol-by- symbol. You have total control with advanced tools to manage and rebalance your investments. |

Create and customize direct index models based on the composition of ETFs tracking major indices. |

| Browse Model Portfolios | Learn Abotu Custom Indexing |

Advisor Portal

A free and powerful client relationship management (CRM) platform

for advisors on the IBKR platform.

Integrated Client Management

Manage the full client acquisition and relationship lifecycle, use a Client Risk Profile tool to understand client risk tolerances and administer each client account.

Efficient Design

Use simplified workflows, logically grouped menus and user access rights to efficiently manage your relationships from any desktop or mobile device.

Reliable Client Onboarding Processes

IBKR offers multiple options for adding clients and migrating to our platform, including a mass upload feature and support for customized client account applications using our application XML system.

Manage User Access Rights

Create one or more Security Officers for the master account and designate up to 250 users by function or account.

Reporting & Analytics

PortfolioAnalyst

PortfolioAnalyst lets your clients link their investment, banking, checking, incentive plan and credit card accounts into a complete portfolio view to calculate returns, understand risks and measure performance against benchmarks. Use the Performance Attribution report to quickly understand how weighting (sector allocation) and contribution to return for each sector compare to the S&P 500 for the period of the return.

Learn About PortfolioAnalyst

Powerful Reporting Solutions

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account.

Flexible Client Billing

Use our CRM to implement flexible fee structures, automate fee administration and provide dynamic fee management.

Flexible Fee Structures

- Invoice clients for services rendered using automatic billing, electronic invoicing or direct billing.

- Fee structures for charging clients include percent of net liquidation value, blended fees, flat fees, percent of P&L, performance fee threshold or high-water marking.

Automated Fee Administration

- Assign client fees to individual accounts or use client fee templates to apply fees across clients.

- Charge client commissions to your master account or easily reimburse fees to client accounts.

Dynamic Fee Management

- Set maximum invoicing amounts or percentage caps.

- Meet your compliance obligations by notifying your clients of advisory fee details.

Client Support

Advisors on the Interactive Brokers platform have access to a number of resources for efficiently managing their business.

Website and Branding Support

White brand statements, client registration and other informational materials with your own organization’s identity, including performance reports created by PortfolioAnalyst.

IBKR Advisor Client Sites provides a complimentary website with custom graphic design and modern functionality. We will work with RIAs to create a customized, professional business website.

Advisor-Led Webinars

Join our quarterly advisor-led roundtable discussion on how advisors use the robust tools and features available on the IBKR platform to manage and grow their business.

Compliance Support

IBKR provides compliance support for advisors.

Advisor Service Models

Registered investment advisors can choose from three service models, which offer enhancements such as:

Operational Control

The service models allow you to complete various tasks, such as funding requests and information changes, on behalf of your clients. Once entered by the advisor, clients will use a simplified process to approve, sign and confirm your action.

An Enhanced Dashboard

The Client Pending Items tab (formerly Pending Items) on our Dashboard shows you all pending tasks for your clients and allows you, as the advisor, to complete the task on behalf of the client or send an automated email asking your client to address the task.

Improved Messaging

We redesigned our Sub Account Messages tab and streamlined communications from IBKR by aggregating, categorizing and routing messages to the advisor to avoid unnecessary client contact.

We offer three customizable participation levels:

| Authorization Level | Streamlined All-Client Enrollment | Streamlined Plus All-Client Enrollment | Full-Service Per-Client Enrollment |

|---|---|---|---|

| Overview |

Offers a simplified process for clients to approve funding requests, sign agreements and confirm changes or instructions entered by the advisor. Communications from IBKR are aggregated, categorized and routed to the advisor to avoid unnecessary client contact. Advisors can configure the specific features. |

Advisors can perform certain adminstrative tasks on behalf of clients. Clients may use a simplified approval process for task requiring their approval instead of logging into Client Portal. Available authorizations are applied to all of an advisor's clients who are automatically enrolled during application. |

Clients allow advisors to perform additional tasks on their behalf, including administrative tasks and the ability to move funds or assets to new places. Each client must enroll individually and select the powers they want to grant to the advisor. |

| Authorizations | |||

| Core Authorizations | |||

| Vote Shares and Make Elections Regarding Positions | |||

| Request to Send Electronic Notices, Confirmations and Account Statements only to Advisor | |||

| Update Account Information, Account Settings, Trading Permissions and Tax Forms | |||

| Special Programs and Alternative Investments | |||

| Provide or Change Banking and Transfer Instructions | |||

| Send Third Party Payments and Wires | |||

| Client Approval Method | Text Notification | Text Notification | No Approval Required |

| Auto-enroll All Clients | Yes | Yes/No | No |

| Eligibility | U.S. advisors who are duly registered.* | SEC registered advisors or CFTC registered advisors who are also state registered, with at least USD 100 million in assets under management. | Registered advisors subject to compliance review. |

| Requirements | Advisors and clients must sign IBKR documentation. | Once the advisor is enrolled, all eligible new clients will be enrolled during the account application process and cannot opt out of the program. Existing clients must sign an addendum for authorization to apply. | Advisors must maintain professional registration status. Clients must complete and submit an executed form. |

*Eligible advisors will be enrolled during the application.

Discover a World of Opportunities

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

150

Markets

34

Countries

27

Currencies*

Global Markets

*Available currencies vary by Interactive Brokers affiliate.

Graphic is for illustrative purposes only and should not be relied upon for investment decisions.

Explore Our Global Offering

Bond Marketplace

Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. We do not widen spreads, apply hidden fees or markup quotes.

Mutual Fund Marketplace

The Mutual Fund Marketplace offers an extensive availability of mutual funds from around the world. Use our Mutual Fund Search Tool to search funds from more than 550 fund families and filter funds by country, fund family, transaction fee or fund type.

Short Securities Availability

The Shortable Instruments (SLB) Search tool is a fully electronic, self-service utility that lets clients search for availability of shortable securities from within Client Portal.

IBKR GlobalAnalyst

IBKR GlobalAnalyst is designed for investors who are interested in international portfolio diversification. It helps you find new opportunities to diversify your portfolio and discover undervalued companies that may have greater growth potential.

Overnight Trading Hours

Trade select US stocks and ETFs around the clock, five days per week. Access US stocks and ETFs when market-moving news happens and trade during Asian market hours or whenever it is convenient for you.1

Access to Cryptocurrencies

Seamlessly access Bitcoin, Bitcoin Cash, Ethereum and Litecoin from our advanced trading platforms, with commissions of just 0.12% to 0.18% of trade value.*

- *Depending on client monthly volume, with a $1.75 minimum commission per order, but no more than 1% of trade value.

- Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses.

IBKR

Nasdaq Listed

$14.6B

Equity Capital*

74.6%

Privately Held*

$10.2B

Excess Regulatory Capital*

2.56M

Client Accounts*

2.35M

Daily Avg Revenue Trades*

IBKR Protection

*Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

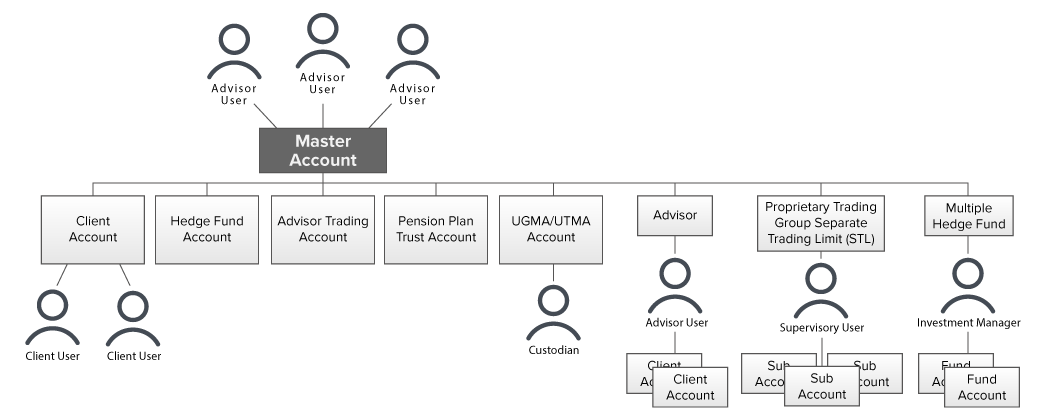

Advisor Account Structure

Account Information

- With our global financial advisor account structure, advisors can support clients from over 200 countries and territories with a single, integrated advisor master account.

- Advisers should conduct their own research and/or seek legal advice regarding their registration requirements. Advisor registration requirements and the number of clients an advisor can have without registering vary by jurisdiction. For example, advisers in the US must be registered with the SEC if they have more than $100 million AUM or with the state(s) where they operate for (US securities) if they have more than $25 million AUM or a certain number of clients specified by the state (typically 1 or 6), unless you fall under an exemption from registration. Similarly, advisors who hold themselves out to the public for commodities must register with the CFTC and become an NFA member unless you fall under an exemption from registration.

- The account can be white branded with an advisor's corporate identity.

- The account can be white branded with an advisor's corporate identity.

- Advisor master account holders must be age 21 or older.

- Professional Registered Investment Advisors can create multiple tier accounts by adding Advisor, Proprietary Trading Group Separate Trading Limit (“STL") and Multiple Hedge Fund master accounts to their account structure. Each Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master account on the second tier can add client/sub/hedge fund accounts as required. Individual and Joint account holders under an Advisor account structure can add authorized traders to become STL accounts.

Open a Registered Investment Advisor Account

Our Advisor accounts let Professional Registered Investment Advisors (RIAs) and Commodity Trading Advisors (CTAs) execute and allocate trades among multiple clients from a single order management interface.

View Institutional Account Types

View Individual Account Types

Disclosures

The projections or other information generated by PortfolioAnalyst® or Tax Loss Harvesting regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

The information provided here is not intended to serve as tax advice and should not be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local, or other tax statutes or regulations. It is also important to acknowledge that this information cannot be relied upon to resolve any tax issues.

- Lowest Cost Broker according to StockBrokers.com Online Broker Survey 2023: Read the full article Online Broker Reviews, May 18, 2023. "Because Interactive Brokers' core clientele are professional traders and institutional investors (e.g., hedge funds), it is crucial to provide the lowest commissions schedule available. In our rigorous assessment, there is no question Interactive Brokers delivers."

- Restrictions apply. See additional information on interest rates. Credit interest rate as of April 2, 2024.

- For complete information, see our margin rate comparison

- Eligible advisors will be enrolled during the application.

- Available currencies vary by Interactive Brokers affiliate.

- Any discussion or mention of an ETF is not to be construed as a recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

- Depending on client monthly volume, with a USD 1.75 minimum commission per order (but the minimum is subject to a cap of 1% of trade value).

- Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.